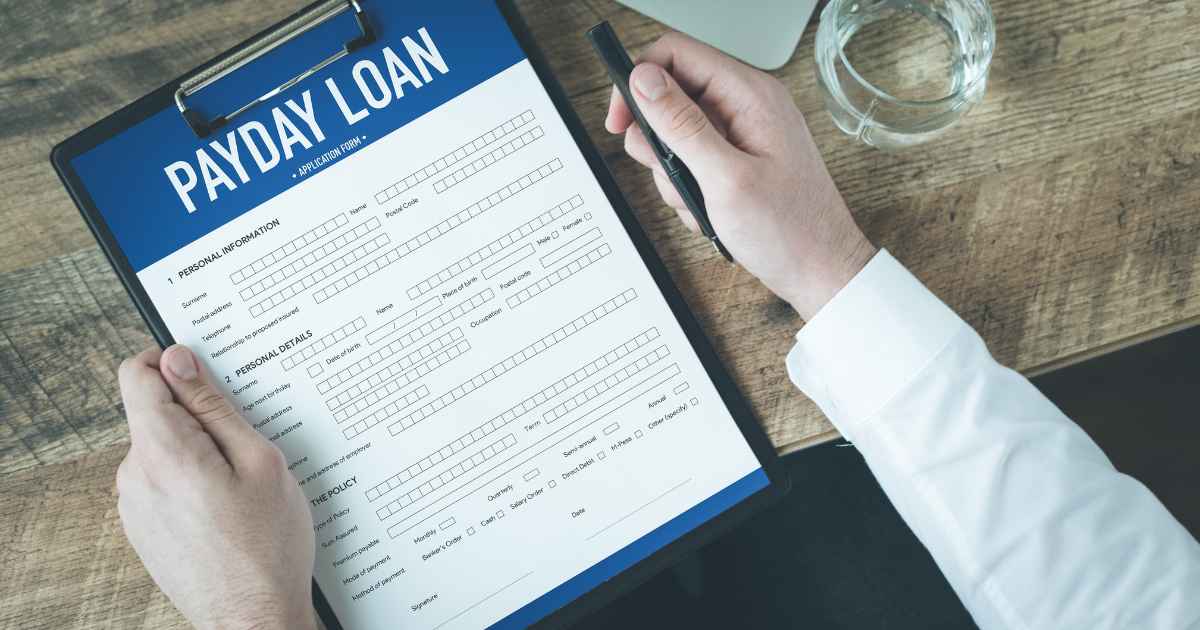

For individuals in need of immediate financial assistance, payday loans have emerged as a popular choice.

These short-term loans, often referred to as cash advances or paycheck advances, provide quick access to funds for unforeseen expenses or to bridge the gap until the next paycheck.

They can be helpful for people who have bad credit but still need to access money quickly.

If you’re curious to learn more about payday loans, read on as we delve into various aspects, including the reasons behind their negative reputation, their benefits, low-cost versus high-cost lenders, bad credit loans, and borrowing limits.

The Negative Perception of Payday Loans: Unraveling the Truth

It is no secret that payday loans have garnered a reputation for being less than reputable.

Many perceive payday lenders as taking advantage of individuals facing financial hardships.

Historically, borrowers have faced exorbitant interest rates and fees, sometimes as high as 400% of the original loan amount.

Disturbing reports of borrowers trapped in a cycle of debt due to overwhelmingly high interest rates and penalties have further tainted the industry’s image.

Improving Legislation: Towards Fairer Practices

Recognizing the need for reform, some countries are changing their laws to prevent lenders taking advantage of people in vulnerable financial situations.

For example, New Zealand introduced legislation in 2018 to curb exploitative practices within the payday loan industry.

The new regulations cap interest and fees at 100% of the loan amount, ensuring borrowers’ repayments remain reasonable.

This is indeed a positive step, but it’s important to note that high-cost lenders still exist.

Lenders charging more than 50% interest annually are considered high-cost lenders, leading some payday lenders to maintain interest rates at 49.5% to avoid this label.

Unveiling the Benefits of Payday Loans

Despite their tarnished reputation, payday loans offer some benefits over other types of loans.

One key advantage is their short-term nature.

These loans typically span a few weeks, providing individuals with enough time to manage their expenses until their next paycheck arrives.

In contrast, personal loans offered by banks or finance companies often require a minimum term of six months, making them less suitable for those seeking smaller, urgent loans.

Furthermore, payday loans are generally easier to obtain, even for individuals with a poor credit history.

While traditional lenders may deny loan applications based on creditworthiness, payday lenders may still provide assistance, albeit with higher interest rates.

Recognizing these nuances is crucial for making informed decisions about payday loans.

Conclusion: A Balanced Understanding

It is essential to grasp both the drawbacks and advantages of payday loans when considering them as a financial option.

While payday loans have faced criticism for their unethical practices, recent legislation and reforms aim to address these concerns.

By fully understanding the terms, risks, and benefits associated with payday loans, individuals can make informed decisions that suit their immediate financial needs.

Remember, responsible borrowing is vital, and exploring alternatives, such as budgeting, seeking financial advice, or considering different loan options, is always advisable.

MoneyMantra, is a passionate content creator with over 5 years of experience in writing about the intersection of technology, business, finance, education, and more. With a deep understanding of how these fields empower both individuals and businesses